NFT Marketplaces: decentralized creativity or 1990s e-commerce?

If NFTs are such a revolution, why are artists still paying 15% commission?

Update: The NFT artist we originally interviewed for this article felt that our criticism of high NFT commissions might cause problems with admins at the marketplace where they sell their work. We temporarily removed and then re-published this redacted version of the article in order to protect the anonymity of the artist and avoid potential financial repercussions. (And yes, in a truly decentralized marketplace, such worries should not exist.)

NFTs are supposed to represent a revolution for artists and collectors, but the marketplaces which sell these NFTs rarely seem revolutionary at all.

That’s probably because most NFT marketplaces follow the same ol’ Web2.0 business model: centralized platforms that charge sellers a high commission in return for bringing traffic to their product listings, while the platform also extracts value in the form of customer and transaction data, giving it a privileged role in the marketplace.

Considering that the code to mint an NFT and bring it to life as a transferable asset on a blockchain is very simple, it makes you ask the question: “Why is the artist sacrificing their profit for this?”

The reality of NFT commissions

Edward Snowden recently sold an NFT on Foundation named “Stay Free (Edward Snowden, 2021)” for 2,224ETH. However, since Foundation charges a whopping 15% commission, Edward Snowden could have been 15% “freer” had he chosen a different NFT marketplace.

Why is it that technologies like NFTs can do away with the “middleman” in terms of trust (e.g., proof of authenticity), but not in terms of commerce? Why does there still need to be an agent of some sort to connect buyer and seller? And why does this agent need to be so expensive?

I recently had the opportunity to discuss these things with a successful NFT artist. (They’d rather not be named, so I’ll refer to them s “the artist” or “my contact.”) This person got started in the blockchain space after experiencing the inefficiencies of our current global financial system. When working remotely and billing their clients, the artist discovered that it was easier to transfer Bitcoin internationally than through a traditional bank wire.

It was a natural next step for the artist to sell their work using NFTs directly on the blockchain. Early efforts to sell artwork on SuperRare failed because admins there did not approve the submissions. However, the artist was eventually accepted at a different marketplace that charged 15%, after submitting work under a pseudonym. Though high compared to some other NFT marketplaces, 15% seemed like a fair commission when compared to traditional brick and mortar art galleries that would charge up to 50%.

The ideal marketplace

After interviewing the artist, it became clear that money isn’t their primary consideration. They told me:

“The ideal marketplace is one that is open to all artists”

This comment made me look at the NFT landscape in a different light. Just when the dominant business model of major NFTs marketplaces like Foundation, SuperRare, and Rarible was starting to feel a bit 1990s, I realized that some NFT marketplaces are doing things right — or at least more right — than others.

Here are the top three examples I could find:

1. Zora, the zero-commission option

Zora is an NFT marketplace with a clean UI, where users can create, bid on, and sell NFTs. What makes Zora great is that there are no fees associated with selling your NFTs, because the Zora protocol effectively creates a unique market for each work, allowing the artist to take market commissions from onward sales. The only cost required to post your media on Zora is the gas fee.

When comparing Zora’s NFT and marketplace smart contracts to those of other NFT marketplaces, it becomes clear that Zora’s smart contracts practically have no administrative privileges written into them. Most other NFT marketplaces have smart contracts with significant administrative privileges that could potentially cause a loss of value for users of those platforms.

Additionally, the Zora NFT smart contract also allows owners of NFTs to update the IPFS link of the NFTs that they own. This means that if the IPFS link of your NFT were to fail or get corrupted, your NFT would not become worthless.

Now you might be wondering, what if the owner of the NFT decides to edit or completely change the IPFS link that is written into the NFT? Don’t worry, the devs at Zora already thought of this.

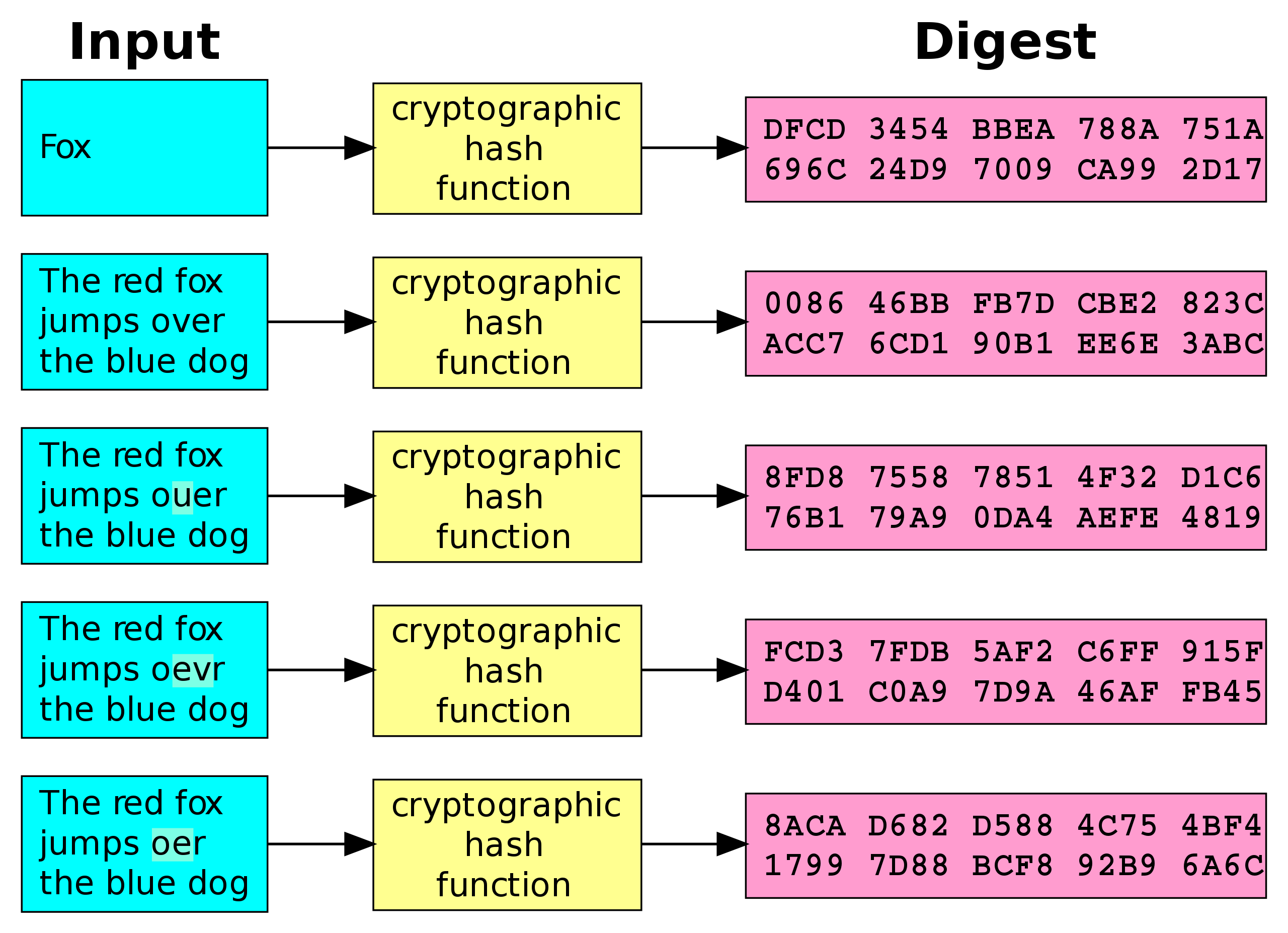

The owner of an NFT can’t change the IPFS link from the original artwork to something else without it being obvious. This is because a cryptographic hash of the initial file uploaded to IPFS is written into the NFT itself. If the IPFS link were to fail, and if the file that the owner of the NFT uploads to IPFS doesn’t exactly match the original, the cryptographic hash will be completely different, signalling that the re-uploaded work does not match the original.

This is a big deal because other NFT marketplace smart contracts do not have such functionality built-in.

Currently, the only issue with selling your NFTs on Zora is that there is not as much volume as there is on other platforms. However, this is bound to change. Zora is the only truly Web3.0 NFT marketplace on the list. If you want to be free from the predatory economic practices that other NFT marketplaces use to keep users locked into their platforms, Zora is the answer.

Zora’s codebase is completely open-source: https://github.com/ourzora

Fees: 0%

**Zora NFT Smart Contract on Etherscan.io**

**Zora Market Smart Contract on Etherscan.io**

**All Zora smart contracts on testnets and Polygon**

2. Hic et Nunc, the avant-garde alternative

Hic et Nunc (meaning “Here and Now” in Latin) is an NFT marketplace built on the Tezos blockchain. Gas fees for deploying an NFT on Hic et Nunc are much lower than on the Ethereum blockchain — as little as a few cents. The commission is also much lower, at just 2.5% paid by the buyer.

Although Hic et Nunc has less traffic than Foundation, it is strongly recommended by my anonymous contact (who also sells his work there) as there is a diverse and active artist community on the platform. This is partly because there are no gatekeepers to accept or reject submissions, and artists can stay anonymous if they wish — a sign of greater acceptance of the philosophy of decentralization.

However, given that the market capitalization of the Ethereum blockchain is currently 100x larger than the market capitalization of the Tezos blockchain, this means that NFTs minted on the Ethereum blockchain are simply more liquid.

***Excellent Medium article to learn more about Hic et Nunc***

Fees: 2.5% paid by buyer

3. OpenSea, the mainstream option that deserves its name

OpenSea is currently the largest NFT marketplace by active users. Founded in December 2017, OpenSea is the most established NFT marketplace.

What’s unique about OpenSea compared to other NFT marketplaces is that if you have your own ERC721 smart contract (i.e., one you deployed yourself), you can use OpenSea’s storefront and auction smart contract to sell the NFTs to a large audience. This is probably why you see NFTs created using other NFT marketplace smart contracts for sale on OpenSea because sellers are trying to avoid paying the high fees of those other marketplaces.

For each sale, OpenSea charges 2.5%, however, the fact that they allow users to use their own ERC721 smart contracts means users can have more control over their NFTs.

Fees: 2.5% (from buyer or seller)

**OpenSea Smart Contract on Etherscan.io**

**OpenSea Transaction Volume on Etherscan.io**

What’s next for NFT marketplaces?

A future in which artists both mint and sell **their own NFTs, by dealing directly with the blockchain to sell in a truly p2p fashion, is still probably some way off (although Zora is pretty darn close). Although it’s not technically difficult to deploy your own ERC-721 smart contract, which would protect an artist from future marketplace policy changes (including changes in fees), it’s currently too difficult to find an audience that way — unless perhaps you’re already famous in the NFT world.

In the meantime, most artists will continue to use some form of marketplace, and competition among those marketplaces will heat up. Sites that feel too Web2.0 today, like Foundation and Rarible, will have to evolve to survive.

Interestingly, SuperRare has recently introduced more decentralized art curation through its RARE governance token, which is a step in the right direction and a sign that marketplaces are beginning to react to the shift in expectations. But even SuperRare still a long way away from its own stated objective of becoming a truly decentralized organisation (DAO).

Ultimately, unless there’s some compelling reason to stay (e.g. a uniquely large audience or amazing curation), users will simply drift to more decentralized options that offer low or zero fees, like the examples I listed above. Indeed, this drift is already starting to happen.

If you want to see how to deploy your own ERC-721 NFT smart contract on the Ethereum blockchain, head on over to my Github!

What do you think about the NFT space and what do you think it says about an NFT marketplace such as Foundation if an artist is afraid to be associated with criticism of their platform?