Why Decentralized Autonomous Organizations (DAOs) Will Transform The Way People Invest

We are entering an era where all capital will be able to move throughout the global economy with far fewer barriers or restrictions. However, blockchain technology has many more use cases than simply providing an efficient means of capital transfer.

The purpose of this article is to highlight one of those “other” use cases of blockchain: The ability to create and deploy smart contracts (self-executing chunks of code) that cement and execute agreements made between individuals, allowing them to cooperate around investing in new ways. To better understand how this could change the financial landscape, let’s take a look at a few examples.

Berkshire Hathaway is one of the most famous traditional investment funds, with over $270 billion worth of assets under management (AUM). Berkshire Hathaway owns outright GEICO, Duracell, NetJets, and an entire list of other companies. For the most part, there isn’t a company that Berkshire Hathaway could not buy outright if they wanted to (they might have to liquidate a portion of their assets, but you get what I’m saying).

However the same cannot be said for the average private investor.

This is how decentralized autonomous organizations (DAOs) can fundamentally change the financial industry.

Wait, so what is a DAO?

A DAO is essentially a framework of smart contracts on the blockchain designed to facilitate the decision-making of a group by executing a predetermined function once a certain set of criteria have been met.

There are many other use cases of DAOs that have nothing to do with the financial world, but that is a topic for another article.

DAOs can function as hedge funds or venture capital funds, making investments or providing liquidity to tech startups. Eventually, DAOs could have more AUM than even the largest hedge funds and will be able to find promising tech startups faster than any venture capital fund could.

Why will DAOs take over the financial industry?

- They are permissionless.

This means anyone can create a DAO and deploy its smart contract code to the blockchain. There is almost no barrier to creating a DAO. All you need is an internet connection, and enough ether (or other protocol currency) to pay for the gas fees to deploy it.

- They are trustless.

This means that once set up and running on the blockchain, a DAO will execute a predefined function once certain criteria are met, without outside intervention.

Since smart contract state and any information stored in the blockchain is visible to all observers outside of the blockchain, individuals can get a good sense of how the deployed smart contract will function, even if they do not have access to the solidity source code itself.

- DAOs are fundamentally more efficient.

The members of a DAO don’t have to even know each other, live in the same country, operate under the same legal jurisdiction, or even speak the same language. This means that the members of the DAO as a whole have greater access to information than any traditional hedge fund, operate with greater autonomy from legal regulation, and can look for investment opportunities where traditional funds wouldn’t even know where to look.

Although skeptical of democracy, even Aristotle acknowledged that “the whole is greater than the sum of its parts”. Philosophers in subsequent eras have also to some extent agreed that the many turn out to be greater than the virtuous few when they come together, even if the many may be inferior when considered individually. A well-known theory in political science that addresses this phenomenon is Condorcet’s jury theorem.

This is why members of a DAO can potentially make better investment decisions than if they would have invested their funds individually.

Additionally, members of a DAO can pool their funds together and can make investments that they would not have been able to otherwise.

We sort of saw this occur on the subreddit, Wall Street Bets, albeit with the participants of the group coordinating their investment decisions in unison as a sort of proto-DAO, not as an actual on-chain DAO.

Less well-known, but just as important, are the examples of great DAOs that are increasingly moving towards on-chain governance: The LAO, Flamingo, MetaCartel, Badger DAO, and more. No longer far-flung ideas, these DAOs are now sought after investors — we know of startups that would prefer to have a strategically aligned DAO among the list of their backers than to have a traditional investment fund. BadgerDAO’s recent $1million investment in 0confirmation is a great example of this.

It’s also worth mentioning that several existing DeFi projects also have active treasury spending procedures to fund core protocol development.

For example, the Uniswap Grants Program, the first Uniswap governance proposal to meet quorum, seeks to fund certain projects and developers who are working to improve the Uniswap ecosystem.

So, how does a DAO make decisions?

The decision-making of a DAO can be done in many ways, ranging from simple to complex, however, most DAOs make decisions through some form of decentralized governance. This means that the individual members of a DAO are given the ability to make and vote on various proposals.

Usually voting in a DAO is handled with the use of a governance token. In this case, the weight of a member’s vote corresponds to the percentage of how many governance tokens they own, to how many governance tokens are in circulation. Essentially, the more governance tokens a DAO member owns, the more voting power they have.

A great place to explore various proposals or take part in DAO governance is on Tally. Tally enables users to explore the types of governance of various DAOs, review past proposals, and cast votes on active proposals.

Tally seeks to become a platform where members of a DAO can come together to vote on various proposals to decide which investments the DAO makes.

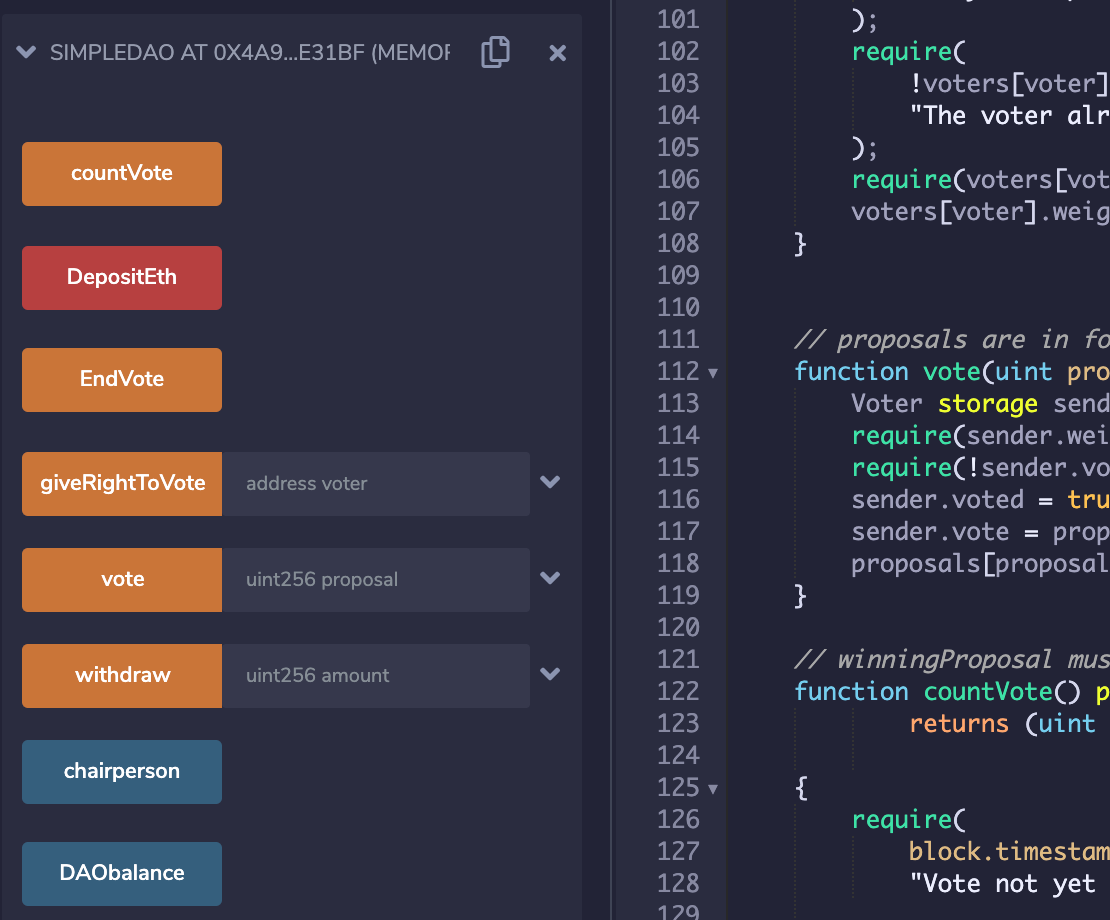

To better understand how DAO voting works, let’s take a look at some actual solidity code. Solidity is the programming language used to create smart contracts that run on the Ethereum blockchain.

One of the best metaphors for a smart contract, as described by Nick Szabo, is a vending machine.

Essentially the logic of a vending machine is as follows:

money + snack selection = snack dispensed

You insert a dollar into the machine, you specify which drink or candy bar you would like, and the vending machine spits out the item you specified.

Here’s an example of a simple solidity smart contract that functions exactly like a vending machine on the blockchain:

pragma solidity 0.6.11;

// https://ethereum.org/en/developers/docs/smart-contracts/

contract VendingMachine {

// Declare state variables of the contract

address public owner;

mapping (address => uint) public cupcakeBalances;

// When 'VendingMachine' contract is deployed:

// 1. set the deploying address as the owner of the contract

// 2. set the deployed smart contract's cupcake balance to 100

constructor() public {

owner = msg.sender;

cupcakeBalances[address(this)] = 100;

}

// Allow the owner to increase the smart contract's cupcake balance

function refill(uint amount) public {

require(msg.sender == owner, "Only the owner can refill.");

cupcakeBalances[address(this)] += amount;

}

// Allow anyone to purchase cupcakes

function purchase(uint amount) public payable {

require(msg.value >= amount * 1 ether, "You must pay at least 1 ETH per cupcake");

require(cupcakeBalances[address(this)] >= amount, "Not enough cupcakes in stock to complete this purchase");

cupcakeBalances[address(this)] -= amount;

cupcakeBalances[msg.sender] += amount;

}

}With the smart contract above, instead of inserting a dollar like a physical vending machine, you send the vending machine ether, and in return, it gives you a “digital cupcake”.

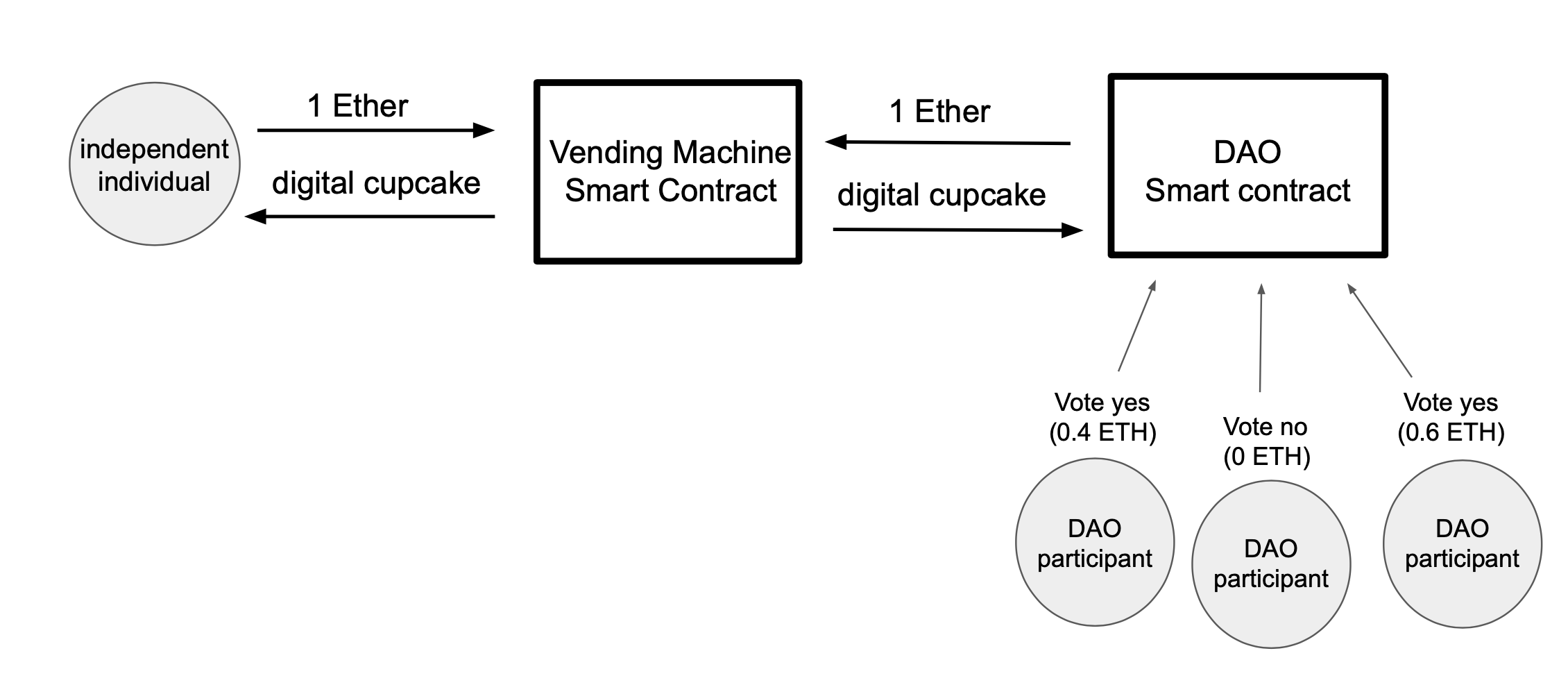

To explore further how a DAO might interact with the vending machine smart contract as compared to an individual, let’s take a look at the following schema:

As you can see above, an individual can directly interact with the vending machine smart contract to buy a cupcake.

But let’s say for whatever reason, several individuals cannot buy an entire cupcake on their own, so instead, they decide to pool their funds together to be able to purchase a cupcake from the vending machine. If the majority of the DAO participants vote “yes”, then the DAO buys a cupcake from the vending machine.

To run the DAO solidity contract above as well as the vending machine code, head on over to Remix IDE and follow the instructions on my GitHub.

This is a very simple example, but I hope you understand where I am going with this analogy. The cupcake is simply an abstraction of any type of asset that the DAO would receive in return for its investment.

So why is this relevant?

No matter how much I go on about how efficient DAOs are for organizing human energy and capital, or how impactful they could be in democratizing investment or bringing greater diversity of thought into investment decisions, nothing in the blockchain space is inevitable. There are plenty of forces stacked up in favor of traditional investment cliques (like the one in the header image) and it could be a while before DAOs overtake regular hedge and VC funds in terms of AUM.

However, by investing in every link in the chain (no pun intended), from DAOs themselves, down to DAO infrastructure and tooling (such as voting tools like Snapshot, easy setup tools like DORA Factory, etc.), BR Capital hopes to play our part in bringing DAO-based investment to life.